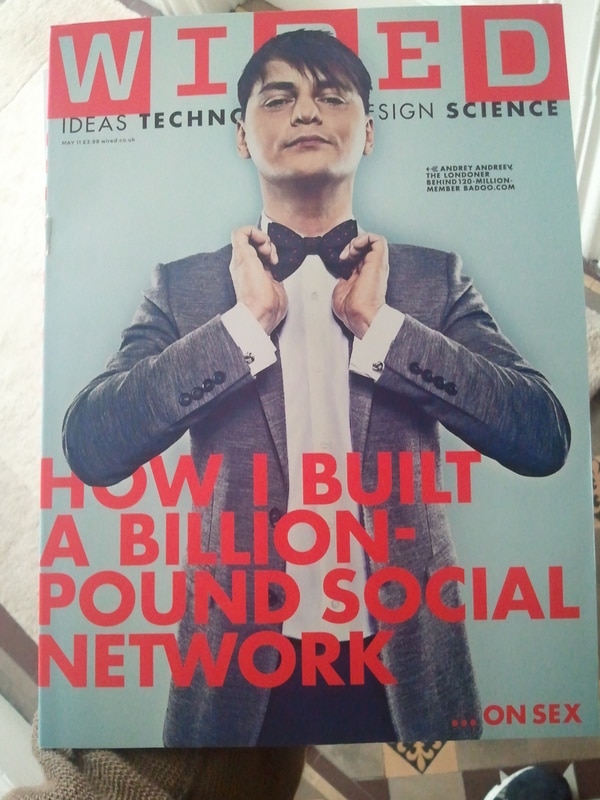

So what do we learn, from the flattering cover feature in this month’s Wired UK, about Badoo, the London-based pay-for-prominence social dating network that not many people have heard of?

Despite a report last year of a possible $1bn+ IPO, in fact, Sequoia and Accel have instead been considering making further investment in Badoo, which is owned 20 percent by Russian investor Finam on a $300 million valuation.

The company’s marketing director, whilst not ruling IPO out, tells paidContent:UK a public floatation wouldn’t necessarily be a natural fit for company founder Andrey Andreev, a serial entrepreneur. But Badoo is in new investment talks: “The majority (of interest) is inbound rather than outbound.”

The reason? Having grown virally, Badoo, on which users list themselves to hook up with fellow users in real life and pay £1/£1/€1 to promote themselves in listings, is popular in Spain, France, Italy, Mexico and Brazil – but still an unknown in markets like North America, the UK and Germany. Expansion in to new markets is expected.

Profitable from those payments from some of its 120 million members, each of whom is looking for a platonic relationship or something more, well, Faceparty-ish, it’s unclear why Badoo would need to raise significant money to facilitate international expansion. Lean in operation, its main project would likely be establishing and staffing national offices.

Having long operated under the radar since its launch in 2006, the company is now putting itself about to the media for the first time in earnest…

Whilst that’s likely part of the investment/IPO process (companies often like to wave good press under VCs’ noses), this reach-out is also part and parcel of the international expansion…

Badoo needs to explain just what it is, and that’s an interesting communication challenge – it wants to differentiate itself from existing networks of friends like Facebook, and from conventional dating websites it thinks are less innovative, in order to describe itself squarely as a place to find new people to meet. In doing so, however, it must steer clear being seen as just a seedy pick-up joint like Faceparty.

Expect something to happen this year, as VC/IPO and PR activity coalesce as Badoo starts trying to put its name in the pot of hot Russian online operators.