In recent years, sceptics have raised the question around the longer-term viability of the holding company model, and its ability to compete strategically alongside the global consultancies. That is why commentators said “the big six ad agencies are heading for extinction” and are “at risk of becoming obsolete”. Cue the calls to ”reimagine” the advertising ecosystem so that smaller independents can move faster than giant holding groups.

For those groups, this was hardly a solid platform to take into the most profound disruption to the ad industry in decades — the evolution of targeting and measurement that is being wrought by regulation and the end of traditional third-party identifiers. Phoenix from the flames. But extinction is not here. Rather, agency groups have soared. One proof point is the share prices of the “Big Five”, which have not only returned to pre-pandemic levels but, in some cases, are also increasing far beyond that, to the levels seen before the onset of agency defeatism.

As reported, Interpublic’s stock is back to its heyday, WPP’s simplification strategy is bearing fruit — the holding companies are back. What’s going on here? Even at a time of reduced brand spend, the holding groups have been proving their value by providing counsel during the most testing business period in years. I agree. Here is how the holdcos are adapting, and can thrive, in the new world.

1. Helping navigate uncharted waters

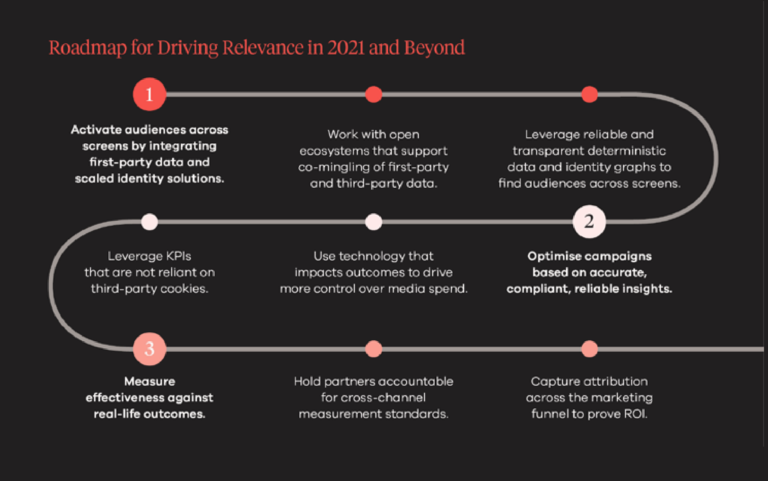

Changes to cookies, mobile identifiers, and more are challenging brands to rethink currency and measurement. With the ecosystem as complex as ever, it is difficult to understand which players will drive strategic business value and what is just vapour.

For some, the answer may be new-wave, old-style, upper-funnel metrics like attention and brand uplift. For others, it may be that leaning into first-party customer data lights up paths to new business barometers like customer lifetime value (LTV).

All of this requires clear thinking. Brands should not be sold a one-size-fits-all approach to new metrics — rather, they need help to better understand business outcomes and how new indicators can create success. With their extensive experience and understanding, holdcos have been helping brands navigate their way in this new landscape.

2. Defenders against digital dominance

Although holding groups have been branded inflexible, they are adapting — not only for a world beyond cookies, but also for a world dominated by a few big digital players. For example, despite a supposed “threat” from tech platforms themselves, MediaCom’s decision to form its own ads division is a smart way to insert itself between brands and tech vendors.

Holdcos also have a new role as champions of digital diversity. We shouldn’t underestimate the complexity associated with multichannel media planning and the resulting outputs of technology choice. Holdcos have a wealth of knowledge, breadth of partnerships, and long history of engaging with innovative companies, both large and small, to the benefit of their end clients. Global consultancies are still playing ‘catch-up’ on this front in order to realistically compete.

The smaller, more nimble consultancies, on the other hand, are able to be more agile and have a stronger understanding of local market dynamics. Many have often been both operators and/or builders of technology. This type of experience proves invaluable to brands seeking to understand what can often be perceived as an overly complex landscape.

What’s clear is that, in a world where differentiation is key, providing non-template plans that create success for brands should be the primary focus for both agency groups and consultancies, so that the default option of the ‘safe bets’ offered by walled gardens becomes less frequent, and we move collectively to support the diversity that can be achieved via the open internet.

3. Trusted tech procurement advice

More brands than ever want to get their own hands on the controls of their software, but that doesn’t mean the holdcos’ role has evaporated – it has just changed. Holdcos are adopting a critical consultative role supporting brands’ technology RFPs, helping clients understand capabilities, rates, contracts, and terms, and bringing potential tech partners to the table. With the breadth of knowledge across all the best tech vendors, they add real value, knowing what can work for each kind of brief. By not standing in the way of direct brand-vendor relationships, the holding groups are staying in the game by again demonstrating a vital intermediary function. As brands increasingly look to enlist demand-side platforms (DSPs), for example, they discover that each, in turn, has multiple partners. Add on specialist viewability and brand safety providers, and it becomes a lot to handle. No wonder some brands are now defaulting back to agencies to help them make sense of it all.

4. Soothing supply-side complexity

Historically, agency groups have played solely on the buy side. But through the growing importance of supply-side platforms (SSPs) and the continued increase in demand for media spend transparency, agencies have to step up, broaden their value base, and help answer that question. SSP affiliations have become a key buyer concern, and supply path optimization (SPO) is now a critical efficiency driver, as more brands realize the complexity that lies underneath the hood.

Curation has been a buzzword of the industry for some time. Agency groups, such as Omnicom, are already reporting improved control, less waste, and better access to supply since the launch of their Marketplace. They work with tech providers to curate only the most relevant audience segments from the most relevant supply sources that are best suited to the needs of their clients.

5. Creating scale from fragmentation

If, in ad tech’s identity revolution, precision is lost, scale is going to matter more than ever. Connected TV ad buyers know this challenge well. Service proliferation has led to a plethora of buying channels, and considerable efforts in labour. But agencies, through their partnerships with tech vendors, have a greater understanding of solutions that can solve these challenges. There has been significant up-take in curated marketplaces, which has removed this buying friction. And big brands still want big reach — but without big overheads. Using networks of individual local operators may seem nice in principle, but it can lead to inefficiencies. When you combine a global brand and a global agency, however, you centralise decision-making — meaning that facilitating global initiatives in local markets becomes more straightforward.

The future is bright. Holding groups have come a long way, and marketplace disruption has given them an opportunity to prove their worth again. But it isn’t perfect yet. We need to see the groups continue to press the innovation pedal — copy-paste media plans don’t fly anymore, and more agency owners are coming to recognise this. If we continue to see changes, the agency-brand relationship will be stronger than ever, built on trust and a better understanding of each other’s needs and capabilities. As a result, holding companies will once again be the source of innovation for brands.