The advertising and marketing technology sectors are going through a stage of explosive growth.

With $3bn invested in new-wave platforms in the first half of 2014 alone, VC interest is strong, while twice as many of these companies are expected to be acquired this year than in 2013.

It would be tempting to say that the adtech and martech sectors, historically linked but distinct disciplines, will enjoy mutual growth, side-by-side in their respective traditional silos.

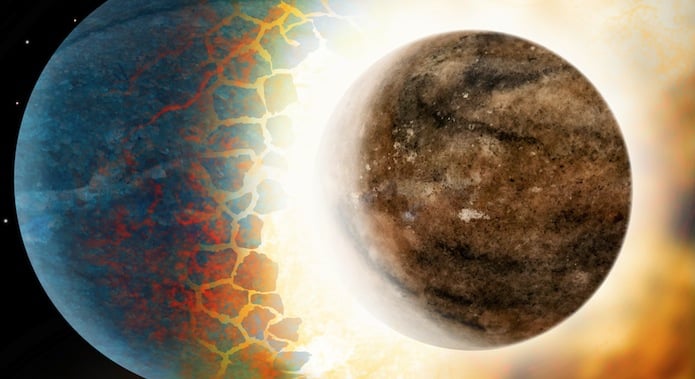

However, I believe these two groups are likely to clash in the not-too-distant future, as they scrap for a marketing world that is rapidly converging.

The data revolution

On the face of it, adtech platforms’ business model is very different from that of marketing platforms.

Adtech vendors facilitate the buying and selling of online ad space, earning their money by taking a cut of spending.

Conversely, marketing services tend to operate a traditional enterprise model, surviving by charging for long-term licenses on a software-as-a-service (SaaS) model.

Now, however, the two are starting to overlap thanks to one valuable resource – data.

For customers of marketing technology vendors such as Adobe, Oracle and Salesforce, data means running more effective campaigns – some users are already well versed in using such services’ customer relationship management (CRM) data to power sales efforts.

For adtech firms, data is the special sauce that powers profiling, targeting and optimised ad buys.

Having already begun to revolutionise the trading of static digital display advertising, these technologies are now changing the burgeoning market for mobile and video ads, turning what has long been regarded as a creative discipline in to a science, and many expect them, eventually, to underpin the biggest ad market of all – television.

The adtech pie is about to get a lot larger.

Convergence

This quest for ever more data has lit up the M&A market for data management platforms (DMPs) – suites that let customers segment and interrogate disparate collections of audience characteristics to better plan multi-pronged digital campaigns.

Existing juggernauts in both spaces are vying for the best tech, with Rocket Fuel, in adtech, having acquired [x+1] and Oracle, in marketing service, buying BlueKai, for instance.

But it is easy to imagine the giants of marketing services, too, buying in to the same space. The likes of Oracle may have heft in CRM, but they currently lack algorithmic mechanisms to buy advertising.

Looking to Europe

I believe European companies will be particular candidates for acquisition in this scrum.

As the founder of industry analysis group ExchangeWire , which tracks the business in this market, recently wrote , to heavyset US groups, European vendors represent a tremendous global growth opportunity and with many not yet being VC-backed are likely to be well-priced targets.

The scene is set for what could be an interesting collision between these opposing sides as they fight to take control of the marketing chain by creating and acquiring the best data management platforms.