UK pay-TV leader BSkyB has put a launch cost on its interesting new over-the-top internet TV spin-off Now TV. It told investors on Thursday:

UK pay-TV leader BSkyB has put a launch cost on its interesting new over-the-top internet TV spin-off Now TV. It told investors on Thursday:

“We estimate associated launch costs of approximately £30 million ($46.4 million) will be required for a through-the-line marketing campaign and support of the new product in the fiscal year to 30 June 2013.”

Finance chief Andrew Griffith said: “It’s in the nature of one-time launch that you’ll see in the first half of the year.”

That gives us a clue how much BSkyB is investing to protect its heavyweight satellite and triple-play offering from disruption by new over-the-top (OTT), cord-cutting services and platforms, and to seek new online customers – 0.44 percent of its 2011/12 revenue.

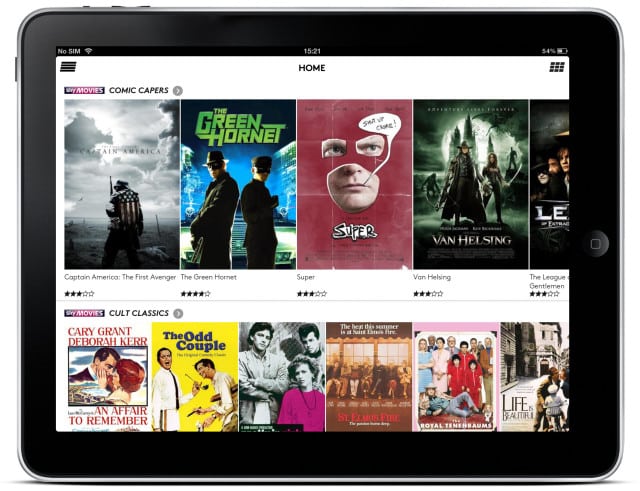

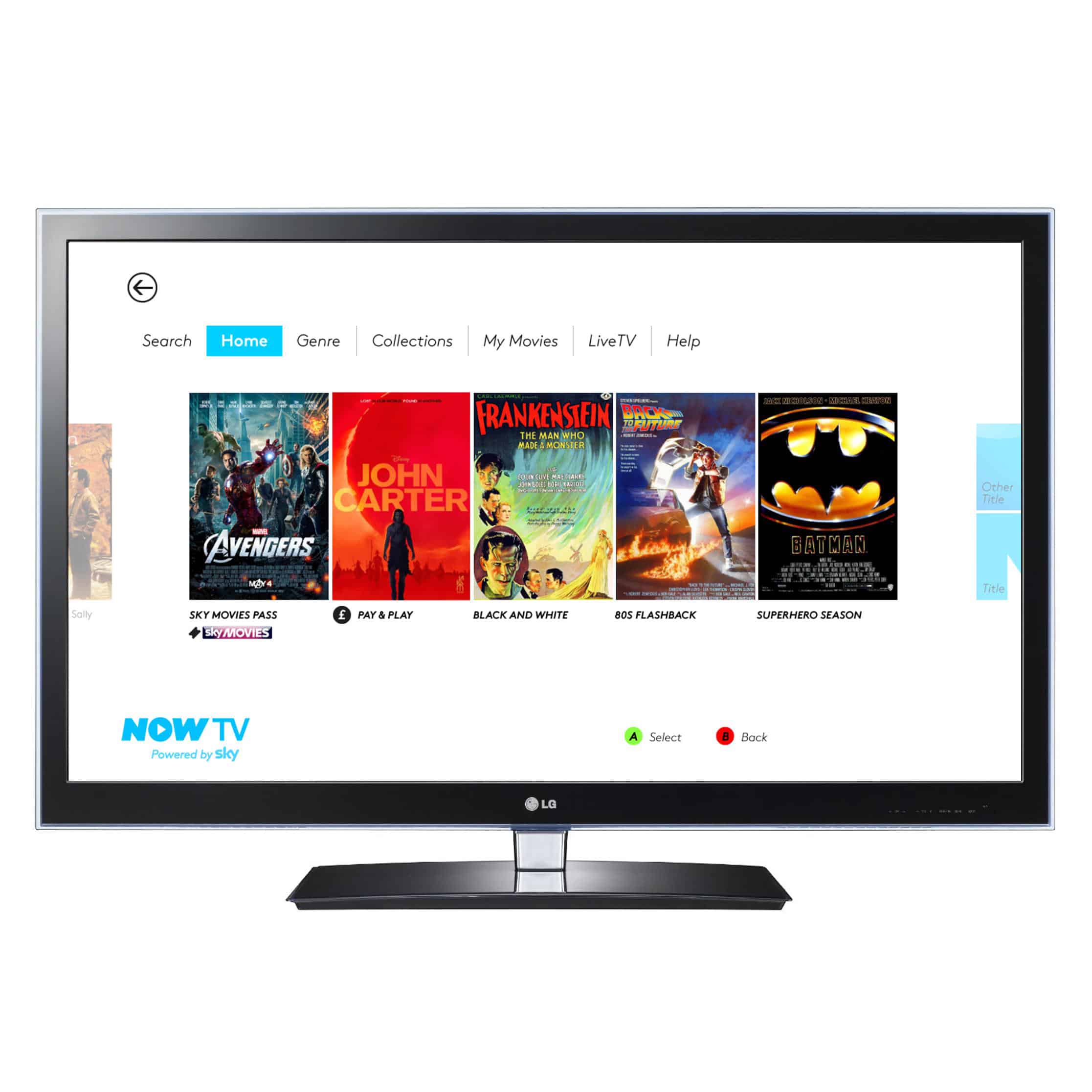

Now TV will offer Sky Movies for a lightweight, £15 monthly contract or one-off movie rentals to Xbox, Apple TV, Roku, PS3, iOS, Android and web. Sky Sports and an entertainment package will launch later with more flexible pricing. Over 100 people have been working on the project at Sky, which has developed some Now TV apps in-house.

Cutting its own cord?

The strategy allows us to wonder whether BSkyB, with Now TV, will ultimately cannibalise its own core satellite, telephone and broadband offering – migrating itself from a high-infrastructure-cost business (putting satellites dishes on walls and boxes in living rooms) to this flexible alternative, in which consumers buy their own, non-Sky devices and broadband.

But Sky is unlikely to ditch its current successful model (customers, locked in to monthly payments over a 12-month contract, pay an average £548 per year) for a model in which customers can pay it only trifling amounts, less frequently.

At Sky’s Thursday analyst briefing, CEO Jeremy Darroch stressed Now TV will be “complementary” to the core offering…

He sees Now TV as an opportunity to go after new paying TV customers who are currently Sky refuseniks.

Later, it may have opportunities either to up-sell big satellite subscriptions to them or, conversely, to inject some of Now TV’s flexible operation model in to its core satellite service.

But Sky is not about to flip its successul model, with 10.5 million customers, entirely. By isolating Now TV as a separate brand, Sky is effectively running it as a £30 million startup within BSkyB – a learning exercise and a search for new customers in nooks and crannies.

Asked whether Now TV represented self-cannibalisation, CEO Darroch told analysts on Thursday:

“They’re different propositions. We will target them in to different segments.

“There’ll be some degree of overlap. But, if we can get it right, we’ll build the totality of the business more successfully.

“You never completely eliminate that risk – if that was the case, you’d only ever stick with one brand. But we’ll be able to create more value than if we had one.”

Enders analyst Benedict Evans says:

One way to look at NOW TV is to imagine Sky asking what would disrupt their business, and then building it: img.ly/kU8R

— Benedict Evans (@BenedictEvans) July 17, 2012