[slideshow]

BSkyB will worry Netflix and set sail for new pay-TV growth in the post-satellite age from Tuesday, when it switches on its internet-only new Now TV service – its biggest digital gambit to date.

But this week’s launch is only a partial and low-risk debut version of what, in time, could become a significant, era-defining strategy for the operator.

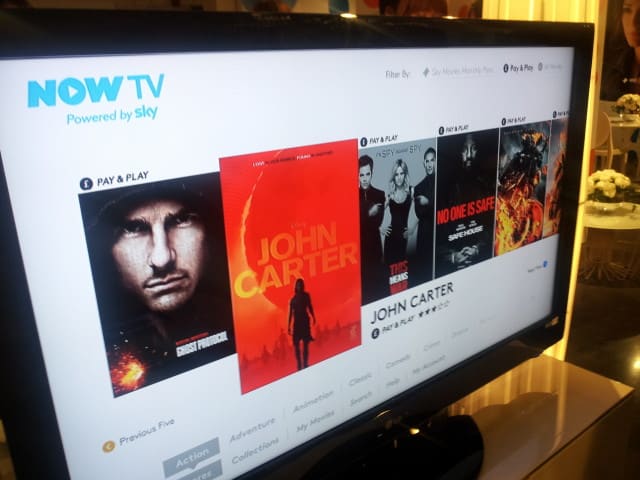

At a Covent Garden, London, briefing on Monday, Sky unveiled only one of Now TV’s three expected bundles (Sky Movies) and committed to launch the other two (Sky Sports and entertainment) only by year’s end. (Release).

What is it?

Although the UK pay-TV leader, the largest slice of which is owned by News Corp, already offers its live and on-demand TV to internet devices through Sky Go, that is as a value-add for core satellite subscribers. In a brave move, Now TV will stream the same programming over a range of internet devices instead of satellite, and for flexible monthly and pay-per-view fees instead of an annual monthly contract.

Sky, whose premium content includes exclusive first-run Hollywood movies and Premier League soccer, has signed up over 10 million satellite households to date, but this growth is plateauing. Now TV gives it a shot at attracting a new generation of paying viewer from the remaining 30 million non-pay-TV households.

Now’s movie advantage

Although the recent launches of Netflix and Lovefilm’s UK online movie subscription services might be said to pose a challenge to Sky Movies, they do not enjoy Sky’s top-tier movie line-up. By pricing its Sky Movies Pass at £15 per month versus Netflix’s £5.99 and Lovefim’s £4.99 (“introductory”), Now TV is being upfront about the relative value of its own content.

Netflix’s heavy recent UK marketing efforts have been establishing online movie rentals in consumers’ mindset – now Now TV intends to market its quality differentiation. Interestingly, the £15 pricepoint is also roughly equivalent to Sky Movies on satellite (but Now TV will benefit from the absence of traditional satellite and set-top box infrastructure capex).

Aside from subscription movies, Now TV is also effectively rebadging BSkyB’s satellite Sky Store – on-demand PPV movies priced £0.99 to £3.49. This access method enjoys quicker movie availability after cinematic release, and sees Now TV go up against Blinkbox in internet video.

Sport late off the blocks

Launching Now TV now with movies but without sports and entertainment suggests Sky wanted urgently to counter the threat from Netflix and Lovefilm.

Now TV’s Sky Sports carriage, including Premier League soccer, could be a huge hit. But Sky executives, asked why it is not available at launch, said only that it would be available around autumn in what is an incremental evolution. Missing the season’s August opening could damage its chances.

“There will be subscription options that aren’t a rolling monthly contract, less than 30 days,” a spokesperson told paidContent. We might imagine Sky F1, Premier League or Heineken Cup weekend or season passes. As a fan of some sports and teams but not all, I would happily pay to watch Scarlets Heineken Cup matches or the Monaco grand prix, for instance, but not for a service that also includes the overkill of cricket, tennis and rugby league.

A low-risk revolution

With all the rights and much of the technology already in place, Now TV is able to dip Sky’s toe in IPTV subscription waters without much effort.

In fact, the launch seems positively lightweight. Although BSkyB is investing heavily in Scottish call centres, there will be no telephone customer support, which will be delivered only via staff live chat. The primary support avenue will be customers themselves, who will be encouraged to share their own solutions in a forum, earning kudos and badges in a manner reminiscent of the low-cast, crowdsourced mobile network Giffgaff.

Cannibalisation vs growth

If there is a risk, it is that Now TV proves so popular that Sky subscribers swap their Sky satellite, broadband and telephone packages (average annual customer revenue: £546) for Now TV.

Making more granular sports available could grow Sky Sports’ overall take – but it could also see it reap ever-smaller fees from an otherwise growing customer case. Informa Telecoms & Media senior analyst Ted Hall writes:

“Now TV represents a potentially dangerous move away from the bundled approach to selling pay TV … towards an a-la-carte model. Consumers are finally being introduced to the cherry-picking model they always wanted. The allure of such freedom could be stronger than Sky intends. What started out as a defensive move against the new OTT players in town could backfire if cannibalization of its core business takes hold. The key will be to keep Now TV on a leash.”

But that prospect, if it exists, is far down the line. To use Now TV, customers must sign up for a Sky iD account – that gives it the opportunity to up-sell Sky’s other services to Now TV viewers.

“Although Now TV is likely to grow the overall market it will be some time before it significantly impacts Sky’s overall revenues,” writes Strategy Analytics’ head digital analyst Ed Barton.

Before then, BSkyB can use many leverage points to make Sky TV more appealing than Now TV – for instance, HD and 3D programming. Although the Xbox application will soon offer 720 streaming, other devices will get only adaptive-bitrate quality. Spokespeople assure paidContent this is for bandwidth, not business, considerations – but it’s easy to imagine the operator holding back best quality for dish renters.

And, though connected TVs like those from Samsung and LG are soon to produce a living-room internet TV explosion, Now TV currently has no firm plans to stream to these sets, saying it is only now talking with manufacturers.

» Interview: Now TV boss goes ‘lean’ to repackage Sky online