Wall Street has welcomed another Chinese digital media stock, video operator YOU On Demand, just as Facebook continued disappointing investors.

Wall Street has welcomed another Chinese digital media stock, video operator YOU On Demand, just as Facebook continued disappointing investors.

But what does the history of Chinese digital stocks, of which there are many in New York, tell investors about both companies’ future courses?

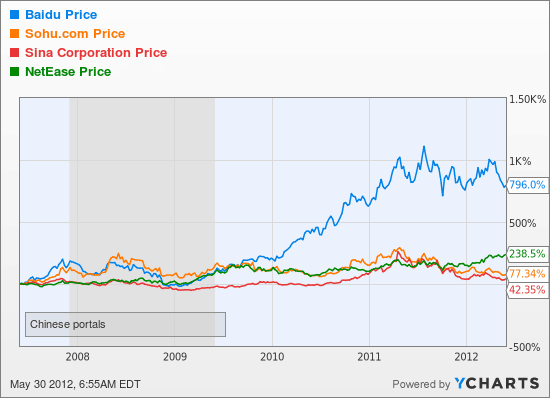

Portals – have provided decent returns, but Baidu has led the way…

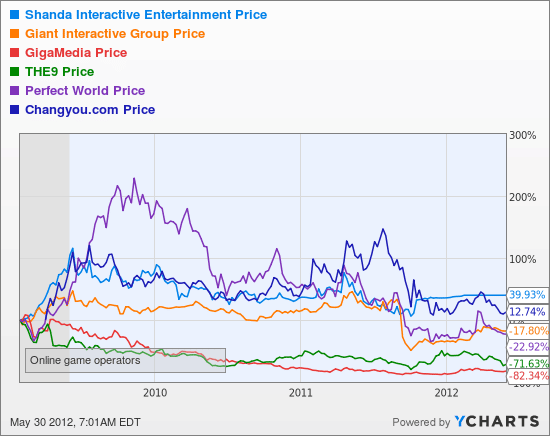

Online gaming – the segment is huge in China, raking an estimated $1.7 billion in Q1 2012 alone. But, whilst locally-listed Tencent leads the way, most U.S.-listed operators have fared poorly

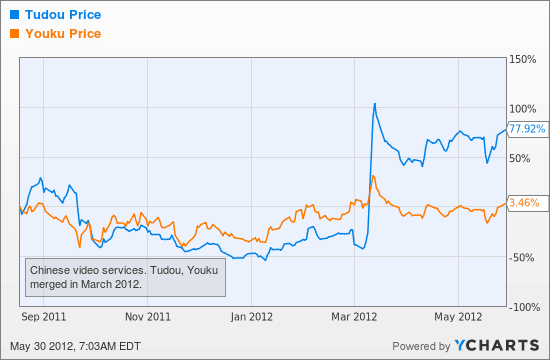

Video sites – the main independent sites not affiliated with portals languished since their floatation. But their March 2012 proposal to merge, in a bid to cut licensing and distribution costs, boosted especially Tudou, whose stock Youku is buying.

Social – Often called the “Chinese Facebook”, the visually-similar real-name network RenRen has been a disaster on the Nasdaq, despite almost doubling revenues within a few months last year. Are investors starting to worry about China’s growing state social media censorship, or about the growth of microblogs from portal powerhouses like Sina and Tencent?

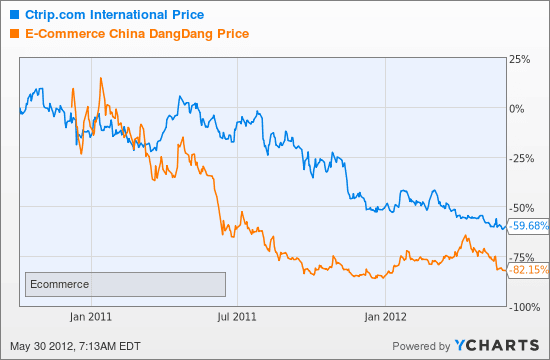

E-commerce – these should be boom days for businesses serving China’s growing digital affluent class. But travel booker Ctrip and diversified Amazon rival DangDang, which is also moving in to e-books and e-readers, are way below their 2010 opening prices.

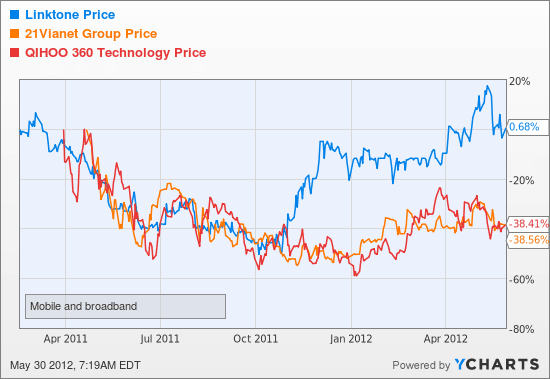

Mobile/broadband – Mobile ringtone, game and news provider Linktone is climbing back from a slump, but mobile security outfit Qihoo 360 and data centre host 21Vianet have tracked each other on the way down, only seeing improved fortunes during this 2012 year of the dragon.