Is Rovio’s floatation ever going to happen? For some time now, we’ve been reading chatter about an imminent IPO.

The latest date is 2013, the latest market is Hong Kong. And, this time, the company itself is making bold on-the-record plans…

“Disney (NYSE: DIS) is worth around $60 billion. That is our goal and there is no reason why we could not build a company that size,” Rovio marketer Peter Vesterbacka tells business paper Tekniikka&Talous in Rovio’s native Finland.

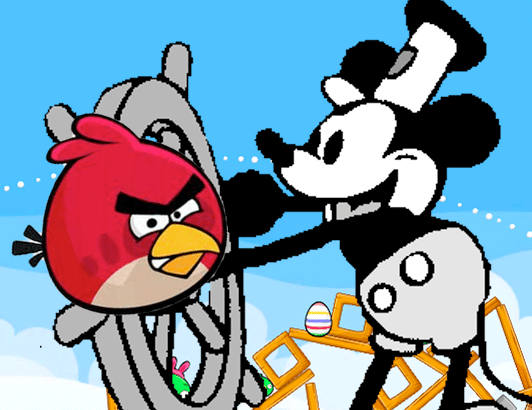

Rovio’s parallels with Disney are clear. Each has a very popular franchise in Angry Birds and Mickey Mouse respectively; Rovio is creative the interactive-age version of pioneering cartoon entertainment. But the differences are obvious, too…

- Disney got an early hit with Mickey Mouse’s Plane Crazy and Steamboat Willie but quickly expanded its portfolio with a broad lineup of other characters and franchises.

- Rovio, however, had developed a whopping 51 under-the-radar mobile games and nearly fell bankrupt before finally finding its Angry Birds hit in December 2009.

Now the game-maker finds itself essentially a single-franchise company, churning out update upon update and new products like plush toys of the pigs and birds.

The amount of interest consumers have left in Angry Birds will be a critical factor in the timing of Rovio’s IPO ambition, which has now been pushed farther back and which the company had previously said would take place on Wall Street.

Vesterbacka tells Tekniikka&Talous Rovio is planning five or six new games based on Angry Birds characters in 2012. But Walt Disney might have seen fit to develop new animations with entirely new characters, at the same time as growing the core franchise.

It would be surprising at this point if the money Rovio is making can’t support new developments. But this may be why it is seeking a floatation fundraising.