Ahead of the coming connected TV opportunity, availability of movies through UK online services is still poor – and Lovefilm has amongst the poorest of selections, according to research.

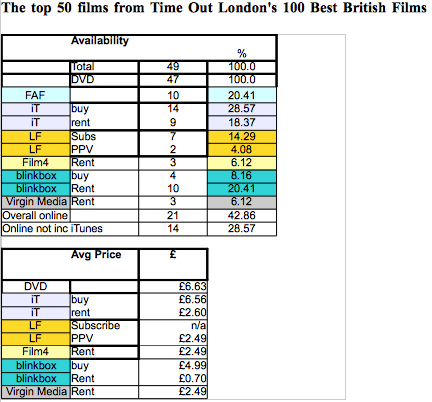

Although most of the films which come top of critics’ and buyers’ lists are available on DVD, online services have only about half of titles, says the Open Rights Group’s (ORG) audit. And that is only about 27 percent if you ignore iTunes.

Although Amazon-owned Lovefilm is often lauded as a market leader, ORG’s audit quantifies what paidContent has been reporting this year – that its online catalogue is poor. Judged on some of the leading lists of top movies, both Lovefilm’s online subscription and its online PPV packages have fewer titles than even the services Filmflex runs for Film4oD and Virgin Media.

This all suggests that, despite growth, consolidation and opportunity in the space, the UK online movie sector is still the Wild West. There is still ample opportunity for better services to come along and dominate. Netflix (NSDQ: NFLX) is planning a UK launch, YouTube (NSDQ: GOOG) is slowly improving its catalogue and Janus Friis is planning his new service Vdio.

In a paidContent article this spring, Forrester Research analyst Nick Thomas criticised content owners for not creating compelling enough services to meet what is actually a growing consumer inclination to pay for digital content.

The problem in movies – News Corp.’s Sky Movies has exclusive rights to the six Hollywood majors’ blockbusters. The UK’s Competition Commission has provisionally ruled this anti-competitive and is currently considering how to level the playing field. But some analysts expect remedies to be minimal and arriving only in 2014, meaning a true opportunity for these upstarts could be a long way off.

ORG carried out this research to lobby UK legislators that, rather than throttle freeloaders’ bandwidth and block access to pirate sites, they should first be creating the conditions for a thriving legal online content market, such as has happened in music in the case of Spotify.

Tesco-owned Blinkbox’s catalogue compares with favourably with iTunes’. Lovefilm is likely to be subsumed in to Amazon (NSDQ: AMZN) next year and Blinkbox is due to be rebranded under Tesco (Blinkbox PR says there are no rebranding plans).

ORG audit highlights:

“Digital prices do not compare favourably to those of DVDs. For the best selling DVDs from August 2011 the average price was ï¿¡6.80. For iTunes purchases, of the films available through it’s service, the average price was ï¿¡8.88. For blinkbox purchases the price stood at ï¿¡9.49.

“The quality of films available online also does not compare well with physical media.

“The film market online is dominated by one service and overall offers a poorer selection, higher prices and lower quality than the physical media market. It is not a compelling consumer offer.

“There are obvious problems with the licensing and availability of films online. If the goal for policy makers is cultural markets that thrive in the digital age, then a vital element of this must be ensuring that consumers’ demand is satisfied online.”