Analysts say News Corp.’s (NSDQ: NWS) bid for BSkyB (NYSE: BSY) is likely to happen, after it made a proposal to divest Sky News that ticks regulatory boxes.

DataExplorers tells paidContent:UK BSkyB it sees investors “voting with their feet” – the proportion of hedge funds betting in short-selling that the deal will collapse is tiny, suggesting a high degree of confidence that the deal will come to pass.

Enders Analysis also thinks the deal is likely to go ahead, but isn’t so convinced a Sky News demerger is necessarily in Sky News’ interests: “The concept of demerging Sky News is evidently a plausible one and we consider it very unlikely that critics of the deal will have much success undermining its appropriateness as a protection of plurality,” Enders says in its latest report.

“However, it is harder to judge whether the proposed implementation secures the channel’s independence as fully and clearly as it might.” The firm notes “a series of issues that the information supplied for the public consultation does not appear to deal with”, including a loophole…

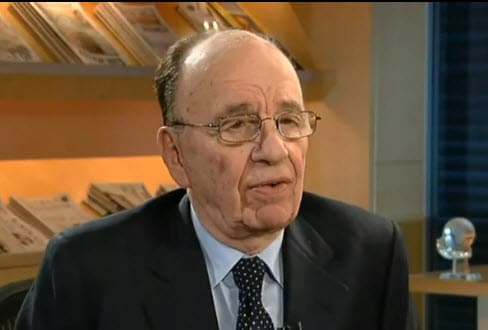

“In particular, the proposed undertakings seem not to block Rupert Murdoch, or members of his family, from buying the 60.9 percent of the shares in Sky News not to be held by News Corp.”

Enders says News Corp’s unusual arrangement – to separate Sky News but to give it a lump sum plus ongoing finance for 10 years, while retaining 39.1 percent stake in the news channel – would leave Sky News with an “umbilical” dependence on BSkyB.

In June, News Corp proposed 700p per share for the 60.9 percent of BSkyB it didn’t already own. Shareholders rejected it, seeking 800p. The price has risen during regulatory clearance. BSkyB closed at 829p in London on Tuesday.

DataExplorers says Dodge & Cox, the fund with the largest share of News Corp, will have the biggest say over whether News Corp bests its initial offer.